Discounted Cash Flow (DCF) analysis is one of the most useful economic decision-making tools in investment management.

REIFA Lite is a real estate investment analysis application based on DCF analysis method.

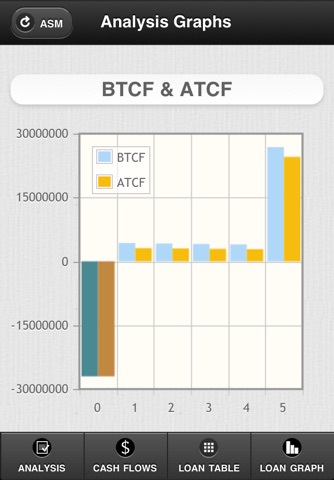

With REIFA Lite you can set multiple parameters and review analysis results with various performance ratios/values, cash flow tables, and charts/graphs for the investment.

It helps you determine whether the investment is worthwhile and profitable immediately.

REIFA Lite calculates the following performance ratios/values:

· NOI(Net Operating Income)

· Cap Rate(Capitalization Rate)

· ADS(Annual Debt Service)

· BTCFo(Before-Tax Cash Flow from operation)

· ATCFo(After-Tax Cash Flow from operation)

· BTCFs(Before-Tax Cash Flow from sales)

· ATCFs(After-Tax Cash Flow from sales)

· LTV(Loan to Value)

· FCR(Free and Clear Return)

· k%(Loan Constant)

· CCR(Cash on Cash Return)

· Leverage Position

· DCR(Debt Coverage Ratio)

· BER(Break Even Ratio)

· NPV(Net Present Value)

· IRR(Internal Rate of Return)

· Payback Period

REIFA Lite has an RSS Reader function.

You can read RSS feeds from HOMES (http://toushi.homes.co.jp) for investment analyses, but please make sure that the feeds are only available in Japanese.

In REIFA Lite, some values are fixed as follows:

· Loan payment method is Equal Payments.

· Property holding period is 5 years.

· Standard value of DCR(Debt Coverage Ratio) is 1.30.

· Standard value of BER(Break Even Ratio) is 70%.

Disclaimer:

This application is made available to you as a self-help tool for your independent use. We do not guarantee its accuracy or applicability to your circumstances. This application is not intended to provide investment, legal, tax, or accounting advice. All examples are hypothetical and are for illustrative purposes and we encourage you to seek personalized advice from qualified professionals regarding all personal finance issue.